New responsibilities for Board members – how to find the most material performance indicators for sustainability?

During the last decades, a common understanding has been reached on how corporate financial performance is defined and calculated. However, in measuring sustainability and non-financial performance, we are only at the beginning of our journey.

New legislation on non-financial reporting came into force in all European Union member countries at the start of 2017. According to the new regulation, public interest entities (PIE) with over 500 employees have to report their non-financial measures and sustainability results in the form of a non-financial statement as a part of the annual corporate governance statement.

The most significant influence of the new regulation is that the Board is now also responsible for non-financial disclosures. Even if the law does not define exact sustainability disclosures and performance indicators, it underlines the responsibility of board members in steering and monitoring a company’s approach to sustainability and due diligence processes relating to significant environmental and social impacts in the value chain. The regulation is flexible in allowing companies to use existing reporting frameworks; however, the content of the non-financial statement should be based on the materiality principle.

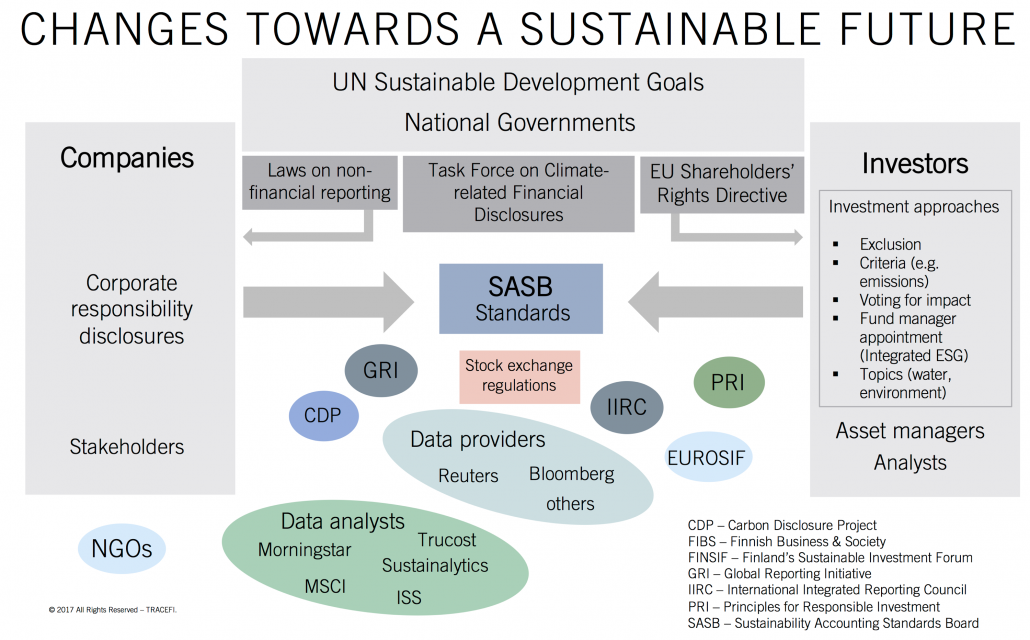

There are many actors in the field of sustainability. On the highest level, countries across the globe have committed themselves to following the UN Sustainable Development Goals. Companies are obliged by new reporting legislation and voluntary standards and initiatives such as the Carbon Disclosure Project.

Standard metrics for sustainability

It is difficult to imagine comparing companies’ financial performance if they could design their own financial disclosures by selecting and highlighting only their desired indicators. That is unfortunately too often the case in sustainability disclosures, but we are moving towards standard metrics for sustainability.

Non-financial reporting is becoming standardised: the most commonly used reporting guidance, the Global Reporting Initiative (GRI) sustainability reporting guidelines are now changed to 36 individual reporting standards. The new ESG reporting recommendation of Nordic Stock Exchanges combines the most important sustainability KPIs of various reporting frameworks. The basis of these frameworks is materiality; however, a burden is that they are not a good enough or unified basis to account for different sustainability features in various industries. A board member should be able to estimate, based on a generally accepted framework, what are the most material sustainability issues to the company and how the company performs in material sustainability issues against its peer group.

The strength of the SASB (Sustainability Accounting Standards Board) standards, which have been developed in the US, is financial materiality and business implications of sustainability; these enable to find the differences between various industries. For example, for a forestry company, the focus is carbon emissions in its production chain, while key issues for the telecommunication industry are related to data security, customer privacy and even children’s rights. SASB concentrates to 10-15 key performance indicators and goals per each industry, which decreases the number of KPIs and simplifies analysing business implications of sustainability in a more focused and consistent way. SASB has defined sustainability disclosure topics and KPIs for 79 industries.

Investors are also showing increasing interest in KPIs that evaluate corporate sustainability. In 2016 the total volume of global responsible investments was USD 23 trillion (26% of all investments) and more than 1700 institutional investors had signed the UN Principles of Responsible Investing (PRIs). Even though SASB is a new and emerging standard, 43% of institutional investors interviewed preferred it as an ESG reporting tool, according to recent research by PWC.

Material sustainability metrics have financial impact

Climate change and UN Sustainable Development Goals are under consideration in numerous C-suites. Focus has been given to decreasing one’s carbon footprint to mitigate climate change. However, only seven sectors of the above mentioned 79 cover 85% of combined CO₂ emissions of all industries. Climate change is also relevant to other industries but its effects are different, and different measures are needed.

There are many evaluators and raters for sustainability, of which several have developed their own methodology for scoring and ranking companies. A recent empirical research from Harvard University shows that the most sustainable companies outcompete and outperform their peers. Companies simultaneously performing well on material sustainability factors and poorly on immaterial sustainability factors achieve the best results of all[i].

Companies should be able to foresee the future guidelines set by investors in reporting sustainability issues material in their relevant industry.

| Susanna Miekk-oja | Mikael Niskala |

| Danske Bank | Mitopro Oy |

| Board professional | Senior advisor and chair of the board |

Writers are founders of Tracefi, which analyses the financial impact of sustainability

[i] *) Mozaffar Khan, George Serafeim, and Aaron Yoon (2016) “Corporate Sustainability: First Evidence on Materiality.” The Accounting Review: (November 2016), Vol. 91, No. 6, pp. 1697-1724