Topics from what we have experienced and learned in the first half of the year, through virtual events and reports, where impact is prominently featured:

- Updates on the implementation of the EU Sustainable Finance Strategy

- Coronavirus and ESG investing

- Investors’ view on the theme: who holds the real power?

- Looking beyond ESG ratings

- Where are we heading?

Updates on the implementation of the EU Sustainable Finance Strategy

The EU does not intend to significantly postpone the already agreed guidelines and legislation related to the implementation of sustainable finance. The Sustainable Finance Strategy is subject to re-evaluation by the new Commission. A survey has been sent for a consultation round (deadline 15/7/2020) and consists of 102 questions, including whether sustainability should be part of management remuneration criteria. The updated strategy will be published in Q4/2020.

Since the updated Sustainable Finance Strategy is part of the European Green Deal, the strategy plays an important role in terms of the package’s criteria and monitoring. The 2018 Action Plan measures targeted the financial sector. The focus of the updated strategy shifts to the real world and to companies, authorities, and citizens.

Timeline of measures:

- Climate benchmark legislation to enter into force 6/2020

- Taxonomy concerning climate change mitigation and adaptation to enter into force through legislation 12/2020

- Legislative amendment concerning the Non-Financial Reporting Directive (NFRD) to enter into force Q1/2021

- The format of guidance to be included in investment advice is on a consultation round, with the aim of entering into force 9/2020

- Until September, there is an ongoing consultation on reporting requirements for investor institutions and service providers regarding sustainability risks. Guidance to be ready 3/2021

- EU Ecolabel for financial products 9/2021

- Taxonomy for the four other environmental objectives beyond climate change to enter into force 12/2021

The above legal and regulatory framework will become part of our national legislation.

Finland’s Finance Finland (Finanssiala) has initiated the establishment of an ESG data register. This is also pleasing because the idea for establishing the register and the preliminary thoughts on its implementation originated from the Tracefi team. We felt the need strongly, as a smaller operator, data availability is difficult and extremely expensive. We based the idea on SASB and GRI standards. We knew the benefits of SASB well, as we were the first in the Nordics to hold a SASB license. More recently, SASB has been prominently featured, not least because BlackRock requires all companies it invests in to report according to the SASB standard. The Finance Finland initiative is based on utilizing these standards combined with the EU taxonomy. The idea is now being carried forward by strong shoulders, supported by a large portion of European financial operators. There is much work ahead. If the register is established, it will enable access to facts reported by companies, allowing us to see beneath ESG ratings.

Coronavirus and ESG investing

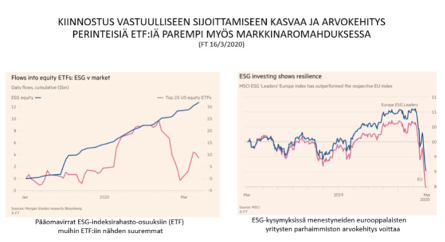

The history of ESG investing is short, and its ability to withstand a market crash has not previously been well measured. However, a recent Morningstar study covering European funds (FT 13/6) shows that over the past three, five, and ten years, six out of ten ESG funds have outperformed their comparable traditional counterparts. Below on the left is an image showing how during the March crash, capital flows directed to equities were mainly allocated to ESG investments (in blue). Statistics show that the same applies to investments in other asset classes. However, if you examine the statistics more closely, you will notice that a major reason for the growth is that many funds have added ESG consideration to their investment policies, some have even merely announced their intention to consider ESG. Not all growth represents new money.

Below on the right is depicted how shares of European companies leading in ESG matters best weathered the corona volatility. A recent study from the USA has been published (click the link), which shows the same applies to shares of American companies.

Another reason for the better returns of ESG investments is that most ESG investors have excluded the oil and gas industry and avoided the sharp decline in oil prices. However, some oil and gas companies are often also the ones building renewable energy solutions for the future. In ESG indices, this exclusion of fossil fuels does not usually occur.

The coronavirus elevated the S (social and human capital) in ESG themes to stand alongside E (environmental). The problem is that there are few generally accepted metrics on the subject and corporate reporting is inconsistent. Among the factors defined by SASB (Sustainability Accounting Standards Board, a non-profit organization defining financially material sustainability standards for investors), employee health and safety, employee satisfaction, supply chain management, and product quality and safety have newly risen as important tools for investors in evaluating companies. Using these factors, it is possible to examine which portion of investments is exposed to these themes and which companies are most affected by the management of these issues. The first studies (Serafeim; Harvard) on the positive impact of good S governance on a company’s share price have been published. More recently, investors have also started examining racial inequality.

As a negative consequence of the coronavirus impact, China announced that its emissions trading system would be postponed. On the other hand, achieving the Paris climate targets seems more realistic through the economic slowdown. However, the actual effects will be studied for a long time to come.

Investors’ view on the theme: who holds the real power?

The outgoing CIO of GPIF, the world’s largest investor (Japan’s pension fund), Hiro Mizuno, began the interview by telling how six years ago when he started in the role, former UN Secretary-General Kofi Annan had said: “Japan is an ESG desert.” His first task was to consider how the pension fund, in fulfilling its fiduciary duty, could best serve future generations. He found no support from the knowledge he had acquired during his studies (MBA in economics, CFA qualification). Because he realized that portfolio managers’ results depend 90% on the movements of global capital markets, he decided to influence making the capital market itself more sustainable. What was particularly missing from his education was a tool for managing systemic risk. Since you cannot protect yourself from it, you must minimize it, which is why he promotes ESG.

Nearly 90% of GPIF’s assets are in passive investments. Mizuno is an opponent of short selling. Therefore, GPIF as a long-term investor prohibited asset managers from using its funds for securities lending in international markets. According to him, this lending activity is precisely what increases volatility in markets. Those who trade the most have the say. If GPIF’s assets are lent out, then “we don’t own anything and someone is using assets borrowed from us to pressure companies.” In addition to short sellers, machine trading also increases volatility. Mizuno laughed that although they are the world’s largest investor, their actions have no say in the markets, but the power lies with machines that operate at enormous volumes in nanoseconds. Machines have more power than humans. That is why he emphasized that humans must focus on long-term investment policy. “ESG is something we don’t want machines deciding about. We don’t want machines deciding what kind of society, what kind of future we have. An investor cannot have responsibility without values. Therefore, values must be attached to portfolio management, that is what ESG is about.”

In the USA, serious concern has already risen that the market share of passive product asset managers is too large. The reason for concern is the concentration of ownership power: the three largest index houses already control over 25 percent of companies in the American S&P 500 index. Within the next twenty years or so, the three largest are predicted to control up to 40% of American companies’ votes (Source: S&P Global Data). The growth of control also extends to those Finnish companies that gain entry to various indices.

It is clear that when, for example, Vanguard has 6 trillion USD in client assets invested through passive products in thousands of companies with only 34 people (FT 12/1/2020) looking after good governance, the owner becomes faceless.

From the US perspective, there is not enough specialization reaching peripheral areas, even Europe, which is a prerequisite for companies to develop a successful strategy, which is the owner’s most important task. The role of local investor institutions as owners is therefore emphasized.

According to Anna Hyrske, Head of Responsible Investment at Ilmarinen, and Hanna Kaskela, Director of Sustainability at Varma, investors can use passive ESG products to tailor investment targets according to their own objectives. Even if you are not a large investor, you can leverage indices developed by others. You can also influence index houses, Hyrske emphasized. Ilmarinen has been involved in influencing the MSCI ESG Leaders index to better account for carbon risk going forward. Kaskela stressed that the entire portfolio does not need to be invested according to a chosen index; portfolio managers should be given their own freedom to invest. There are many options for passive investment solutions, liquidity is good, and costs are low. Hyrske advised choosing passive products carefully: “Google is a good helper.”

The use of climate-themed passive funds has not yet broken through in the pension fund and foundation space. More than half of the world’s largest have not allocated any assets to them (FT 17/6). Two-thirds will increase their share over the next three years. Pension investors are not satisfied with the “lazy ownership” of passive asset managers. In the future, asset managers’ activity in stewardship practice will weigh in their selection, meaning how asset managers exercise investors’ power.

Looking beyond ESG ratings

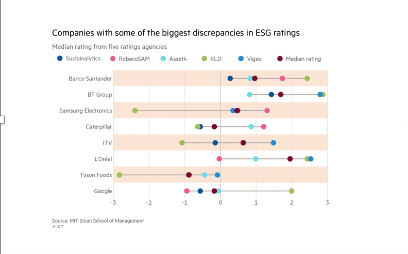

|

|---|

| ESG ratings notoriously do not correlate with each other (Source: FT: MIT Sloan School of Management) |

Hanken professor Hanna Silvola summarized in her presentation the reasons how ESG raters differ:

- Targets (one rater includes emissions, human rights, and corruption; another has different targets)

- Weighting (one places greater weight on E, another on S and G)

- Measurement (one uses employee turnover, another labor disputes)

- Data sources (one uses public sources, another sends questionnaires to companies)

ESG ratings describe “how” companies do things. But for a sustainable future, it is more important “what” a company does. An example is the Russian company Lukoil, which is one of the major holdings in ESG funds due to its high rating.

Where are we heading?

Calvert’s research director John Streur charted the future, what will happen in 2030: considering the ESG perspective in investing is becoming mainstream. The next phase is to measure impact. More specifically, the impact of products and companies. Academic actors are already doing this. It is a major task: one must be able to influence the direction of a company and gain access to companies’ outputs. Inequality emerged as an important theme, as it undermines the economic system. Investors must cooperate with companies.

Over the next ten years, we will experience the greatest and most difficult transformation in work: companies will understand that risks also bring opportunities, they will adapt their structures, variable costs, and use of capital. AI will rise above human capital; the disruption lies in how people are employed and how value is created for the economy.

The ability to shape knowledge into strategy is important. True investor data consists of the ability to understand a company’s strategy. One must move from risk management deeper into a company’s strategy and help management in executing that strategy, especially in the case of active asset management.

ETFs will not take over the world; customized ETFs will become more common, long-term commitment by investors will become possible, where an active asset manager can go into a company to exert influence. How a company navigates in the green economy is already on the agenda. Every company, even if the topic is not financially material, is part of the energy sector transformation, partly also because employees demand it.

Summary

The significance of impact is growing. Impact is bidirectional: on one side, the economic effects of the environment and society on companies, and on the other, the external effects of companies, guided by the UN Sustainable Development Goals (SDGs) as a roadmap.

Impact can only be practiced with knowledge. For direct investing, company-specific information is needed (for example, climate risk assessment), and for evaluating fund assets, fund-specific information. Everything starts with forming an overall picture of sustainability, mapping the current state (Finnish Foundations and Funds Association’s guide “Examples of Responsible Investing”), after which goals can be set and their development monitored.

We continue to develop tools for your use that are beneficial for managing sustainability risks and impact, and thereby also for generating results.

Until we meet again,

Susanna Miekk-oja on behalf of the entire Tracefi team

* Mizuno moved on to become an advisor to Japan’s Ministry of Economy, Trade and Industry on ESG matters, a board member of Tesla, and took positions at Harvard and Oxford as well as becoming an advisor to the CFA community.

** “Building a Passive ESG Portfolio”, FINSIF remote seminar, 5.6.2020

*** ESG data – the capital in the sustainable transition. Hanken remote seminar, 11.06.2020

**** ESG Asset Owner Summit: John Streur, CEO, Calvert Research and Management